The Tesla Science Center at Wardenclyffe may not yet be open to the public, but innovation is already on full display on these hallowed grounds in Shoreham where famed inventor Nikola Tesla conducted research.

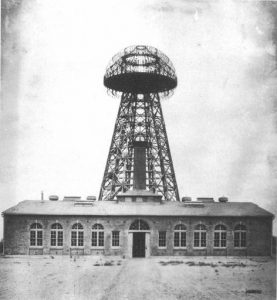

Known for his groundbreaking contributions to alternating current (A/C) electricity, fluorescent lighting, radio, and the technology behind the x-ray, wi-fi, and more, the Serbian-American inventor and engineer has been enjoying a posthumous resurgence in popularity after dying impoverished in 1943. (The 187-foot-tall broadcast tower Tesla built at the Shoreham site was torn down in 1917 for scrap to help pay Tesla’s bills at the Waldorf Astoria.) But now, decades after Tesla’s death, Elon Musk’s celebrated electric car bears Tesla’s name in recognition of the inventor’s creation of the induction motor and A/C transmission, and Tesla is finally achieving the recognition his scientific contributions deserve.

CMM’s Marc Alessi serves as Executive Director of the Tesla Science Center, which is being developed on the Shoreham site as a technology center housing a business incubator for fledgling companies engaged in scientific research, as well as a museum dedicated to educating the public about Long Island’s rich scientific opportunities past, present, and future. The Center’s vision is to educate visitors about the magnitude of Tesla’s accomplishments right here on Long Island and their impact on modern-day life, as well as foster curiosity, experimentation, and lifelong learning.

“This isn’t just another science museum. The fact that Tesla conducted his research on these grounds sets it apart,” said Joe Campolo, CMM Managing Partner and National Advisory Board Chairman for the Tesla Science Center, who recently had the opportunity to venture behind the locked gates for a tour. Once the restoration of the complex is complete, Campolo said, “this Long Island site will be a destination for innovators and science enthusiasts around the world.”

Campolo recently worked to secure an unprecedented donation of one million dollars from CMM client Softheon, Inc. to the Tesla Science Center to help solidify Long Island’s spot in scientific history, and Peter Klein of Klein Wealth Management – HighTower Advisors is exploring partnerships with entrepreneurs and science advocacy groups to bring in additional funding. Programs planned for the site include presentations, lectures, and visiting experts; science teacher association conferences; student field trips; and science competition workshops, mentoring, and awards, as well as a permanent Tesla exhibit and a host of other rotating science exhibits.

Learn more about the story of the Tesla Science Center in these photos, and visit teslasciencecenter.org to contribute to this one-of-a-kind effort.

Marc Alessi, Joe Campolo, and Peter Klein in front of Nikola Tesla’s lab during a recent visit. The lab was designed by noted architect Stanford White.

A look at the lab from another angle. Peerless Photo also operated at this site. Next photo: Alessi, Campolo, and Klein have all taken leadership roles to make the Tesla Science Center a reality and promote Long Island’s rich scientific history.

A statue of Nikola Tesla from the Government of the Republic of Serbia peers out over the site.

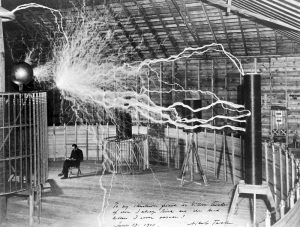

A famous multiple-exposure photograph of Tesla in his Colorado Springs lab in 1899 with a “magnifying transmitter” high voltage generator. Credit: Wellcome Collection https://wellcomecollection.org/works/zncts6ch. Next photo: The broadcast tower, 1904 (photographer: unknown). The tower is long gone, but the lab still stands today.

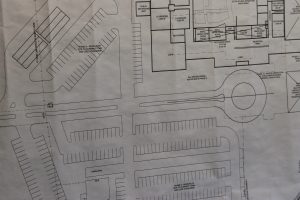

Marc Alessi, Peter Klein, and Joe Campolo examine site plans.

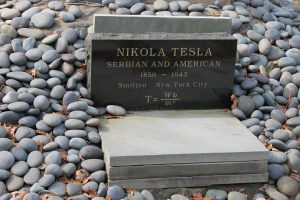

Tesla is now a household name. Next photo: Planning is well underway for the restoration of the site.

Commemorative bricks surround the Tesla statue at the Shoreham site. “TO THE GREATEST MAN WHO EVER LIVED. THIS IS OUR LEGACY.” “Master of Electricity, Man Out of Time.” “In the Space Between Intellect & Insanity Lies Genius.” Next photo: “ENCOURAGE LEARNING AND INNOVATION AT ALL AGES.”

“Tesla: Better Than the Other Guy.” Next photo: “Tesla, still getting walked on after all these years.”

CMM’s Marc Alessi has been instrumental in developing the Tesla Science Center since his service in the New York State Assembly. Next photo: “Here’s to humble scientists.”

“Never forget the underdog.” “For the love of science.” Next photo: “Tesla lives on in the hearts & minds of inventors!”

The future site of classrooms and exhibits at the Center. Next photo: This house will be reconfigured for office space.

Tesla was born in the Austro-Hungarian Empire and had both Serbian and Croatian ancestry. He emigrated to the U.S. in 1884 and ultimately became a U.S. citizen. Next photo: A closeup of part of the former site of the Wardenclyffe Tower.

By Arthur Sanders

By Arthur Sanders