By Bernadette Starzee, Long Island Business News

As CEO of GE from 1981 to 2001, Jack Welch grew revenue more than five times, from $25 billion to $130 billion. The company’s net income swelled tenfold and market capitalization grew by 30 times under his watch. Welch had very definite ideas about leading and managing his workforce, which he discussed in his book, “Winning.”

Campolo, Middleton & McCormick Managing Partner Joe Campolo talked about some of the leadership strategies espoused by Welch in a seminar last week entitled “Winning: Incorporating the Leadership Lessons of Jack Welch into Your Business.”

Survival of the fittest

One of Welch’s principles was applying a “survival of the fittest” rule in evaluating his personnel and business units. Those who survived were those who were needed.

“Back then, when companies were gaining market share, they would increase head count, believing bigger was better,” Campolo told an audience of more than 50 business leaders, who gathered at the firm’s Ronkonkoma training center for the breakfast event. “But Welch was different. He looked at employees and decided whether they were nice to have, or if they were needed. He shrunk the workforce, going with fewer managers and fewer business units.”

It has to be a meritocracy, Campolo said.

“People who do more should be rewarded,” Campolo said. “‘Survival of the fittest’ is necessary. People say, ‘Shouldn’t we employ more people?’ and I reply, ‘I’m a lawyer, not a priest.’ I believe I’m on the planet to use my productive talent to help society move forward and lead others to be productive.”

Welch would eliminate the bottom-performing 10 percent of the company’s sales force at the end of each year.

“This was a clear direction to the workforce, and the salesforce in particular, and it inspired a desire to not be at the bottom,” Campolo said.

Entrepreneurial culture

Welch wanted to instill a culture of entrepreneurship – to let people feel safe to use their brains and not just do what their manager told them to do.

Company leaders should act like leaders, not micro-managers.

“If I have to do your job, then I don’t need you,” Campolo said. “A manager says, ‘Do this, do this, don’t do this.’ A leader will say, ‘What do you think you should do?’ The philosophy should be, ‘Don’t come to me with a problem unless you have a recommendation for a solution,’’’ Campolo said. “As a leader, we might agree or disagree with the solution. As a leader, sometimes you must allow people to make decisions even if you disagree, so they can see the ramifications of their decisions. Of course, you can’t let them make a fatal decision.”

Rules of leadership

Welch’s book lists eight rules of leadership, the first of which is “Leaders relentlessly upgrade their team, using every encounter as an opportunity to evaluate, coach and build self-confidence.”

According to Campolo, “this is what company leaders do. We don’t sleep, and when we do, we dream about more efficient ways to accomplish our goals,” he said. “We must constantly evaluate whether the right people are in the right roles, and whether someone is stronger here and weaker there. At the firm, we are always expanding from within, and constantly coaching and evaluating whether the team has the resources they need to do a good job. If we have to get rid of someone for lack of performance, it’s our fault, whether the mistake was made on the hire, the onboarding or through the training, mentoring, coaching or resources. I will not get rid of someone unless I am confident I have done everything I can to make sure they’re getting the resources they need to get the job done.”

The best way to boost productivity is by boosting self-confidence “with every interaction,” he said.

“People may need to be told that they are not doing something well, but it needs to be done respectfully and in a way that builds confidence,” he said.

“Everyone does something well, but they may not be doing a particular thing well.”

The relentless drive for improvement and increased productivity must start at the top, Campolo said.

“I pride myself on being a life-long learner,” he said. “And every day I want to be the hardest-working person here.”

Living and breathing the company vision

Welch’s second leadership rule is “Leaders make sure people not only see the vision, but live and breathe it.”

Leaders must make the team’s vision come alive – and they have to be genuine about it, Campolo said.

“If you don’t have a passion for what you do, you look ridiculous when you try to fake it,” he said. “No one buys it. The reason the jury system is so good is that we all have really good B.S.-ometers. The only way to inspire is if you have a vision that you believe wholeheartedly and share it every opportunity you get and make sure people understand it.”

After explaining elements of the vision, Campolo will ask the partner or staff member he is speaking with to repeat it back to him.

“I tell them I really need them to understand it,” he said. “It’s critical to our operations.”

His company has a Team Day event each March, where everyone from the mailroom up to the managing partner “rips apart what we did all year and evaluates it as equals,” and participation is expected from the entire team.

“When I hire people, I make sure they understand the vision and that if they are not a part of it, it will be very obvious and that they won’t fit into the ecosystem,” Campolo said.

Getting under their skin

“Leaders get into everyone’s skin, exuding positive energy and optimism” is Welch’s rule No. 3.

“An upbeat manager with a positive outlook ends up running a team filled with upbeat people with positive outlooks,” Campolo said.

Leaders have no choice but to set the tone.

“If I’m in a bad mood on a particular day, it sets a certain tone,” he said. “I didn’t realize it until it was brought to my attention by some of the other attorneys. I realized that I can’t allow the burdens that affect me to impact others. You have to be upbeat and positive every day. That’s how you get productivity out of everyone.”

It isn’t always easy.

Campolo’s father, Joe Campolo, Sr., who had served as the firm’s controller since its inception, passed away unexpectedly last fall.

“I was freaking out, but I couldn’t come to work and show that,” Campolo said. “It was really hard, but I had to set a tone of optimism. We are in a service business, and I couldn’t afford to have people unsure. As a managing partner of 60 people, I had no choice but to show confidence that everything would be okay. No matter what’s going on in your life, you have to pick up every day if you’re a leader.”

Celebrate the good

Campolo went through Welch’s other five rules of leadership, concluding with “Leaders celebrate.”

“It’s probably the most important one,” he said. “You need to celebrate the good with your team.”

The firm celebrates its anniversary every year, along with holidays and other special occasions throughout the year. Last month, the team gathered in the firm’s community room on the Friday before the Super Bowl, wearing the jerseys of their favorite football teams, eating heroes and wings and doing Super Bowl boxes.

“People need to have fun and blow off steam,” Campolo said.

Leading in the community

Leadership is something that can be taught, according to Campolo, who said his firm’s motto for the year is “Leadership and Ownership.”

“Everything we do is about leadership and ownership, and that includes being leaders in the community,” he said.

Planning regular seminars like this one for clients and other business leaders is part of Campolo’s mission to be a leader in the community.

“We try to bring business leaders across all verticals to share stories,” he said. “How we grow is by sharing stories – maybe we can pick up a nugget here or there.”

Read more here.

Mark your calendars! The results of the Hauppauge Industrial Park opportunity analysis will be revealed!

Mark your calendars! The results of the Hauppauge Industrial Park opportunity analysis will be revealed!

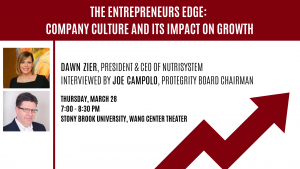

We have designed CMM Academy to help educate and inform our clients, colleagues, and partners, giving them the tools to achieve their business goals and continue their professional growth through a series of workshops and events. As part of CMM Academy, we’re excited to present our Fall 2018 Business Workshops, which have been selected for their timeliness and relevance to the business community.

We have designed CMM Academy to help educate and inform our clients, colleagues, and partners, giving them the tools to achieve their business goals and continue their professional growth through a series of workshops and events. As part of CMM Academy, we’re excited to present our Fall 2018 Business Workshops, which have been selected for their timeliness and relevance to the business community.

Join us as

Join us as