If you have considered purchasing or selling a business treated as an S corporation, you may have heard about structuring the deal as an “F” reorganization for tax purposes. But what exactly is an “F” reorganization and what are its tax consequences?

An “F” reorganization is a type of qualifying tax-free reorganization for corporations under Section 368(a)(1)(F) of the Internal Revenue Code (IRC) that changes the identity or form of a corporation. To satisfy the requirements of this nonrecognition event, a transaction must meet one of the statutory definitions of a “reorganization” while retaining the same essential ownership structure. Private equity firms often take advantage of the “F” reorganization as a means of acquiring an S corporation without engaging in a lengthy consents process while simultaneously gaining the tax benefits of a deemed asset sale.

Congress created the S corporation (small business corporation) in 1958, which provides one level of income tax, passed through to its owners at the individual level. However, S corporations are subject to several limitations, chief among them a limit on the number of shareholders (who must be natural, living persons), capped at 100. Thus, S corporations continue to be a popular tax election for closely held corporations due to their liability protection and tax benefits. Accordingly, many of the closely held businesses that private equity firms wish to acquire are S corporations.

To effectuate an “F” reorganization under the IRC, the IRS has identified the following steps and timing to comply with the proper use of the IRC’s provisions:

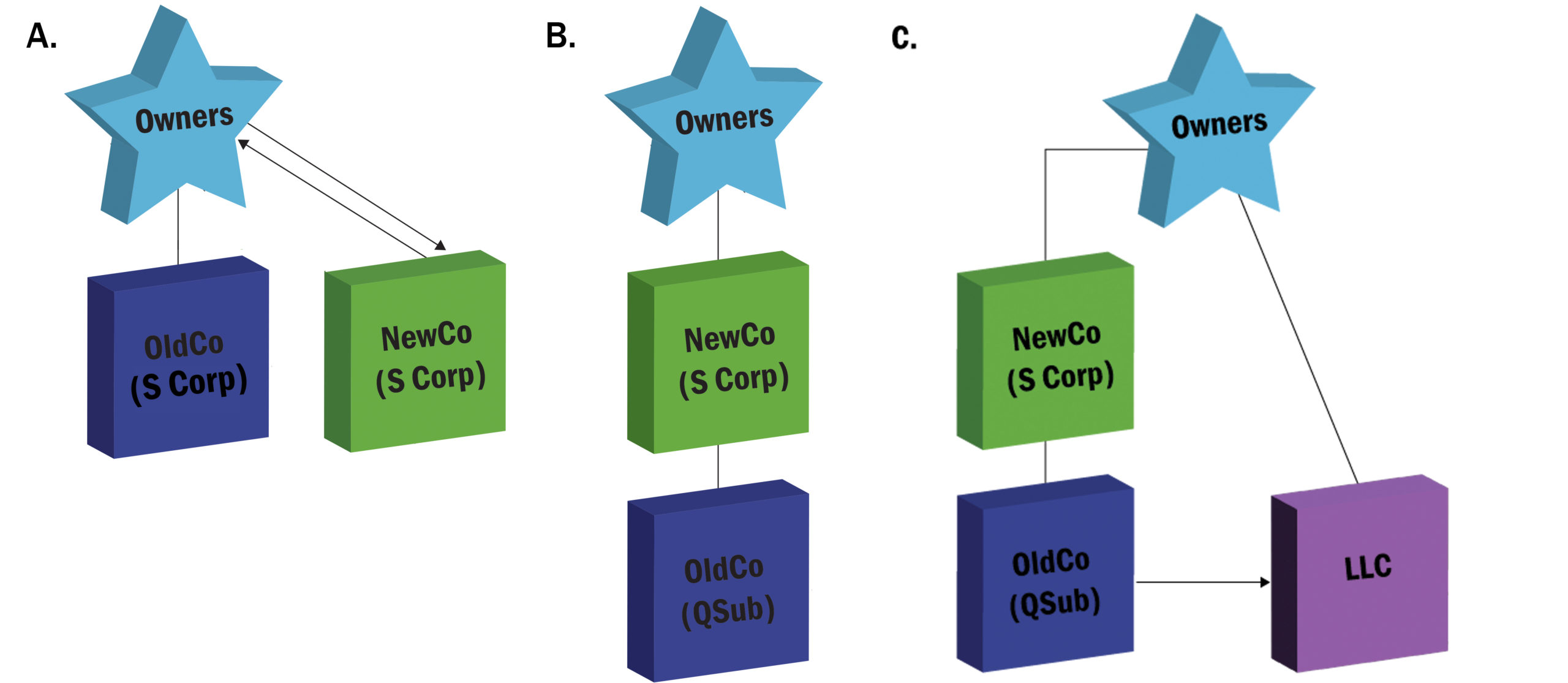

- The owners of the original S corporation (OldCo) form another corporation (NewCo) that they will elect to be treated as an S corporation under Section 1362(a) of the IRC. While this election is not required for NewCo since OldCo’s s corporation election will remain in effect, NewCo will need to conduct such election to obtain a new employer identification number (EIN). (Diag. A)

- The owners of OldCo then transfer 100% of the issued and outstanding shares in OldCo to NewCo in exchange for 100% of the issued and outstanding shares of NewCo. As a result of this contribution and exchange of shares, the owners will own 100% of the issued and outstanding shares of NewCo while NewCo itself owns 100% of the issued and outstanding shares of OldCo. (Diag. B)

- Once the contribution and exchange are completed, the owners of NewCo will form a limited liability company (LLC).

- NewCo will cause OldCo to make a “qualified subchapter S subsidiary” (QSub) election within the meaning of the IRC to treat OldCo as a disregarded entity for income tax purposes, without being subject to the typical constraints on an S corporation. This reorganization is then followed by the conversion of the OldCo to an LLC via state law merger or conversion, depending on the state’s applicable statutory provisions. (Diag. C)

- After the companies merge or convert, the final structure prior to the sale will have the owners owning 100% of the issued and outstanding shares of NewCo, which in turn owns 100% of the equity interest in the LLC.

Due to this reorganization permitted by Section 368(a)(1)(F) of the IRC, the owners of NewCo can now sell the equity of their LLC instead of the equity of the S corporation, which would have been legally prohibited from selling its interest to another business entity. Since the LLC is treated as a division of its parent S corporation, the sale of an interest in a QSub is treated as a sale of an undivided interest in its assets for federal income tax purposes (corresponding to the amount of stock sold), which provides the buyer with a “step-up” in the basis of the acquired assets equal to the amount paid for the LLC’s equity interest, to be used for depreciation and amortization purposes. However, there are several strategies sellers can take to reduce the potential increased tax liability associated with a deemed asset sale including:

- requesting a “gross-up” from the buyer in the purchase price to compensate the seller for any tax exposure they may incur as a result of not being able to instead sell the equity and be subject to capital gains tax.

- offering the seller “rollover” equity in the selling company to soften the tax consequences to the seller.

While navigating the complexities of an “F” reorganization may seem daunting, working with an experienced M&A attorney will demystify the process. Please contact us for guidance or with any questions.

This article is for informational purposes only. For tax advice or guidance, please consult your accountant directly.