Business owners: to avoid civil penalties, be sure to review your pricing model on goods and services to confirm you’re adhering to recently passed legislation. As of September 30, 2020, New York State has banned the “pink tax,” a reform passed as part of the 2021 New York State Budget.1

The “pink tax” describes a practice by retailers, manufacturers, and service providers to charge different prices for “substantially similar” consumer goods or services that are marketed to different genders. The law is in response to instances in which women are charged more, and pay more, for the same goods or services offered to men.2

“Substantially similar goods” are defined by the State as goods that exhibit little difference in the materials used in production, intended use, functional design and features, and brand. “Substantially similar services” is defined as two services that exhibit little difference in the amount of time delivering, difficulty, and cost in providing the service. The State uses the following as examples of prohibited pricing:

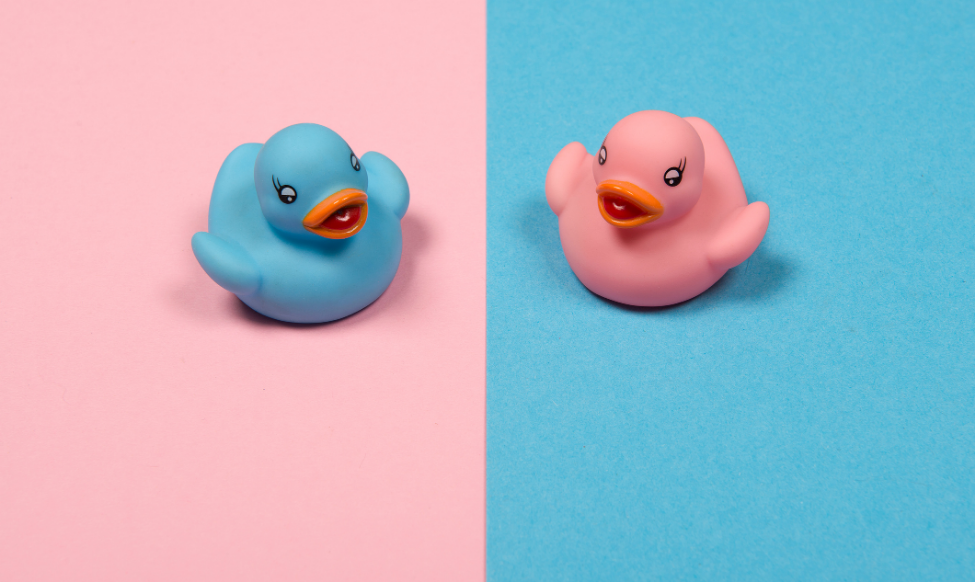

- a store selling a toy in blue for $5.00 and the identical toy in pink for $10.00, or

- a dry cleaner that charges a higher price to dry clean a woman’s dress suit than a man’s dress suit.

To combat discriminatory practices, the law empowers consumers to request and receive a written price list for standard services to ensure any such difference is not discriminatory.

To avoid potential liability, businesses should make sure that any price difference is based upon:

- The amount of time it took to manufacture such goods or provide such services

- The difficulty in manufacturing such goods or offering such services

- The cost incurred in manufacturing such goods or offering such services

- The labor used in manufacturing such goods or providing such services

- The materials used in manufacturing such goods or providing such services

- Any other gender-neutral reason for having increased the cost of such goods or services

The New York State Division of Consumer Protection will handle all complaints, and violations may result in an order to stop such sales, along with restitution to consumers, up to a $250 fine for the first violation, and up to $500 fine for any subsequent violations. Consumer restitution, while in and of itself is not a high cost, could lead to potential class action lawsuits.

Businesses should protect against violations of the “Pink Tax” prohibition to avoid the appearance of discriminatory practices and potential liabilities which may result. If you have questions or need assistance, please contact us at (631)-738-9100 or fill out our form here.

[1] Senate Bill S2679

[2] A Study of Gender Pricing in New York City