Joe Campolo was invited to testify before the New York State Assembly at a virtual hearing on June 17, 2020 about the federal response to the COVID-19 pandemic and its impact on the business community. Below is the text of his testimony.

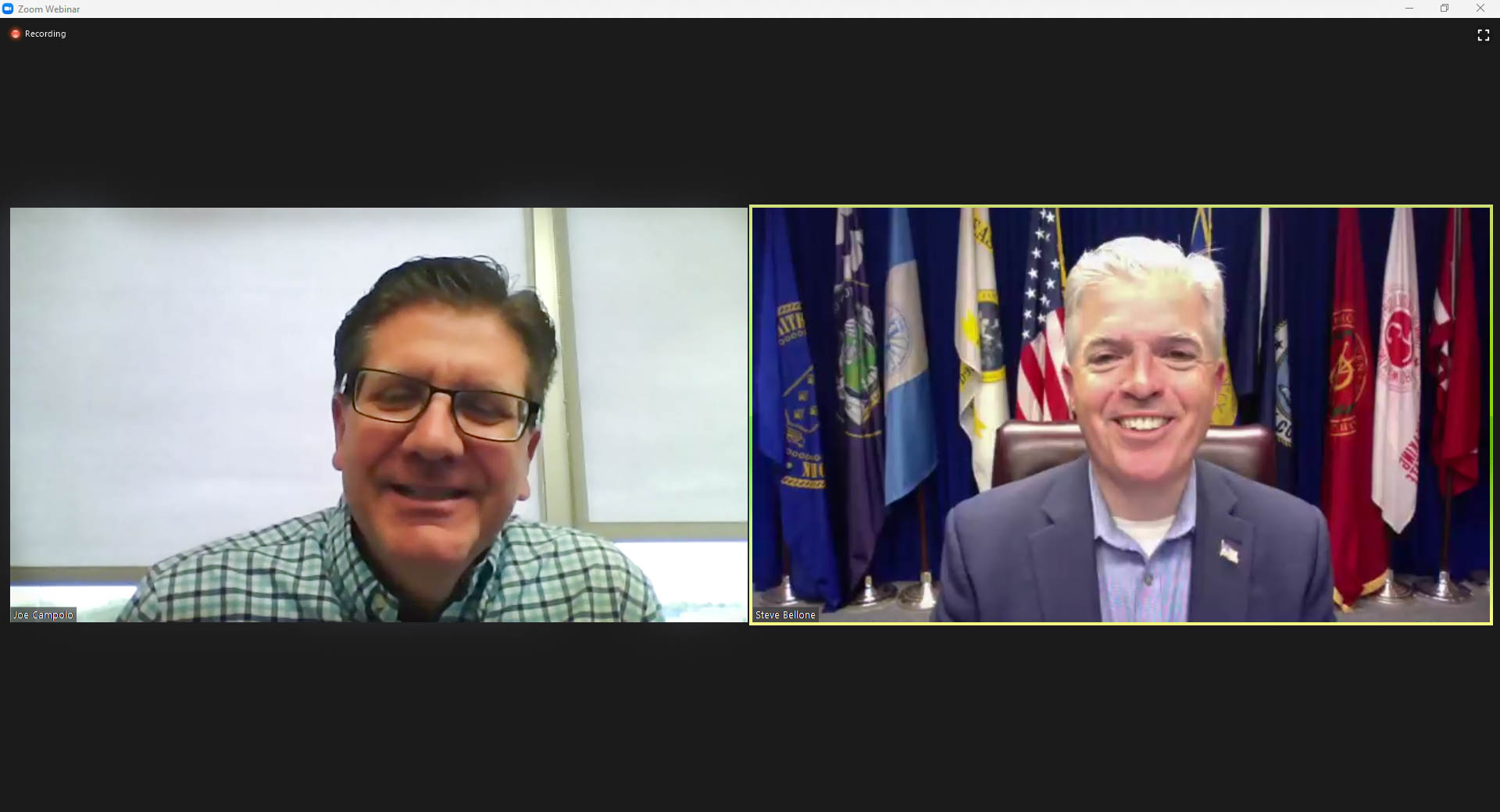

Good morning. My name is Joe Campolo and I am the Managing Partner of Campolo, Middleton & McCormick, LLP, a business law firm with offices across Long Island. In addition to being a small business owner, I have spent my entire career representing Long Island small businesses. I am also the Chairman of the Board of Directors of HIA-LI, steward of the second largest industrial park in the nation (the Long Island Innovation Park at Hauppauge), and home to 1,400 businesses. I also just spent the past hour in a virtual Town Hall with Suffolk County Executive Steve Bellone to hear his perspective. I have seen firsthand and personally experienced the catastrophic carnage that COVID-19 has unleashed on the Long Island business community.

There is simply no playbook about how to get through these challenges. The swift enactment of the CARES Act was welcome news in the early days of the pandemic, particularly the promise of Paycheck Protection Program (PPP) dollars. However, the under-funding of the first tranche (which for all we knew at the time, would be the only tranche) caused unbelievable angst and turmoil. Our firm and many of our clients did not receive funding and were forced to accelerate cost-cutting measures and layoffs.

Fortunately, the second tranche helped mitigate the situation – but the lack of clarity in guidance issued by the SBA and the Department of the Treasury caused these dollars to be used inefficiently. We, along with many others on Long Island, did not want to burn those dollars without work to be done, so we spent countless hours and days that could have been spent productively, instead trying to do mathematical gymnastics to make the numbers work.

Further, the issuance of enhanced federal unemployment benefits in conjunction with PPP dollars caused tremendous inefficiencies that continue today. At many businesses, some people chose not to return to work but to stay home and receive the enhanced benefits. The recent passage of the PPP Flexibility Act certainly helped expand the time to deploy PPP dollars, but unfortunately, many businesses already spent those dollars upon receiving them, at a time when productivity was very low – in essence, wasting those dollars. Had these been the goalposts when the program was first enacted, employers and employees could have worked together to utilize supplemental unemployment benefits during non-productive times, then deployed PPP when work restarted.

To move forward, we must recognize that the economy is driven by productivity, which is driven by worker output – so it is paramount to get people back to work. Here on Long Island, the largest percentage of jobs lost have been low-paying jobs in restaurants, hotels, and the hospitality sector. Our revitalized downtowns, which had become a hallmark of our economic success over the past 10 years, have been decimated. So it is critical to have future and specific relief geared toward those industries.

We should also be making a concerted effort to focus spending on the minority neighborhoods that have been hit hardest by both the health and economic crises of COVID-19. We have an opportunity before us to pump trillions of dollars into the economy – we must seize the opportunity to support these inner-city communities and help correct the economic disparities that existed there before COVID.

Thus, we must make sure that dollars that are earmarked for local municipalities for capital projects are not cut. Infrastructure enables more activity, which in turn promotes long-term productivity. Infrastructure investment in depressed areas therefore serves multiple purposes – adding high-paying jobs where they are needed, thereby increasing productivity, thereby increasing the GDP on Long Island. It is only by growing GDP with high-paying jobs that we will be able to fully recover post-COVID without an overwhelming debt burden.

Thank you.

View a recording of the testimony here.