Campolo, Middleton & McCormick is proud to announce that Senior Partner Patrick McCormick has been elected and inducted as President-Elect of the Suffolk County Bar Association. As President-Elect, McCormick will continue to advocate for the legal community and represent the SCBA in the absence of the President.

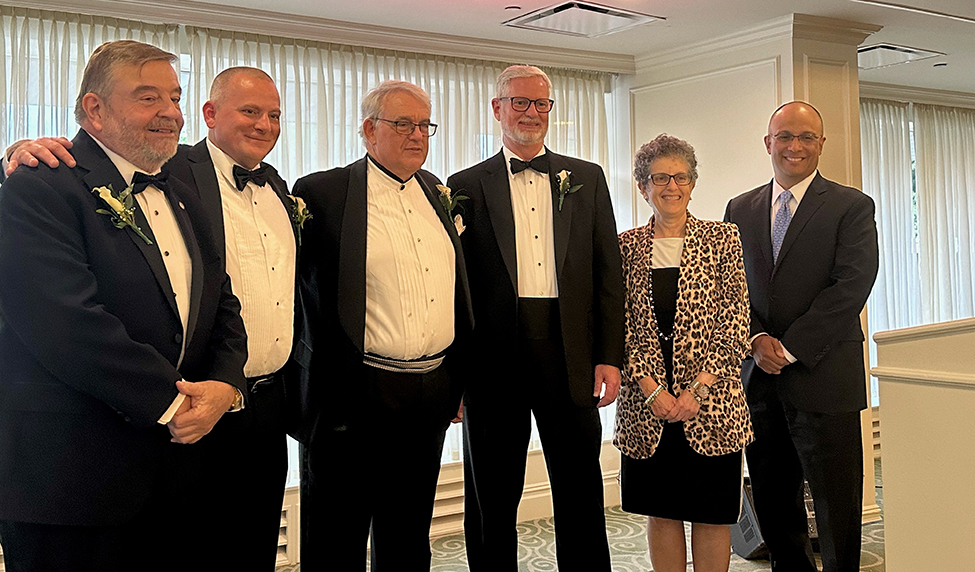

This election is a noteworthy professional milestone for McCormick, who has previously served as First and Second Vice President, Secretary, and Treasurer of the SCBA Board of Directors, as well as Dean of the Suffolk Academy of Law. A proven leader in the community, this election highlights McCormick’s long-standing dedication to the SCBA. McCormick was sworn in at the SCBA’s 115th Annual Installation Dinner at Cold Spring Country Club on June 9th.

McCormick chairs the Appellate Practice at CMM, having built a reputation as a strategic and talented appellate attorney over three decades in the field. Representing clients in civil and criminal matters in both federal and state courts, he has argued numerous appeals, including at the New York State Court of Appeals, the state’s highest court. McCormick is also a respected trial attorney, litigating all types of complex commercial and real estate matters. He represents national commercial shopping centers, retailers, and publicly traded home builders in commercial and residential landlord-tenant matters. McCormick has been recognized by his peers with the Martindale-Hubbell AV Preeminent® rating for ethical standards and legal ability, the highest possible rating from the most recognized legal directory and resource.