Many small businesses often use third-party payment processors such as PayPal, CashApp, or Venmo to facilitate a frictionless payment experience for goods and services that can be made right from a customer’s smartphone. However, due to recent changes in the law, anyone who receives $600.00 or more as payment for goods and services using any of these payment apps can expect to receive a Form 1099-K.

Form 1099-K, Payment Card and Third Party Network Transactions, is a federal informational tax form used to report payments for goods and services to the Internal Revenue Service (“IRS”). Organizations that facilitate these payments, like debit or credit card companies, PayPal, Venmo, and others, are required by law to file Form 1099-K with the IRS and send copies of them to the payment recipient. The Form 1099-K may include amounts considered to be both included and/or excluded from gross income for federal tax purposes.

Previously, the IRS only required this level of reporting if payments exceeded $20,000.00 or more and over 200 transactions were completed during the year. While that reporting is still required, the new lower tax reporting requirement is a result of a change to the tax code in the American Rescue Plan Act, the $1.9 trillion stimulus package passed by Congress and signed into law March 2021. Beginning January 1, 2023, a payment settlement entity (“PSE”) such as Venmo is required to file and send its users a Form 1099-K for transactions made during the 2023 tax year. A PSE is defined by the IRS as “a domestic or foreign entity that…has the contractual obligation to make payment to participating payees in settlement of payment card transactions.”

The IRS said these changes also extend to people who sell items on internet auction sites such as eBay, and even people who run a “craft business” if they accept credit card payments through these apps. To comply with the new requirements, PayPal and Venmo have offered its users a way to tag their peer-to-peer transactions as either (1) personal, for friends and family, or (2) for Goods and Services. For example, users should select the appropriate category of “Goods and Services” whenever they are sending money to another user to purchase an item or paying for a service.

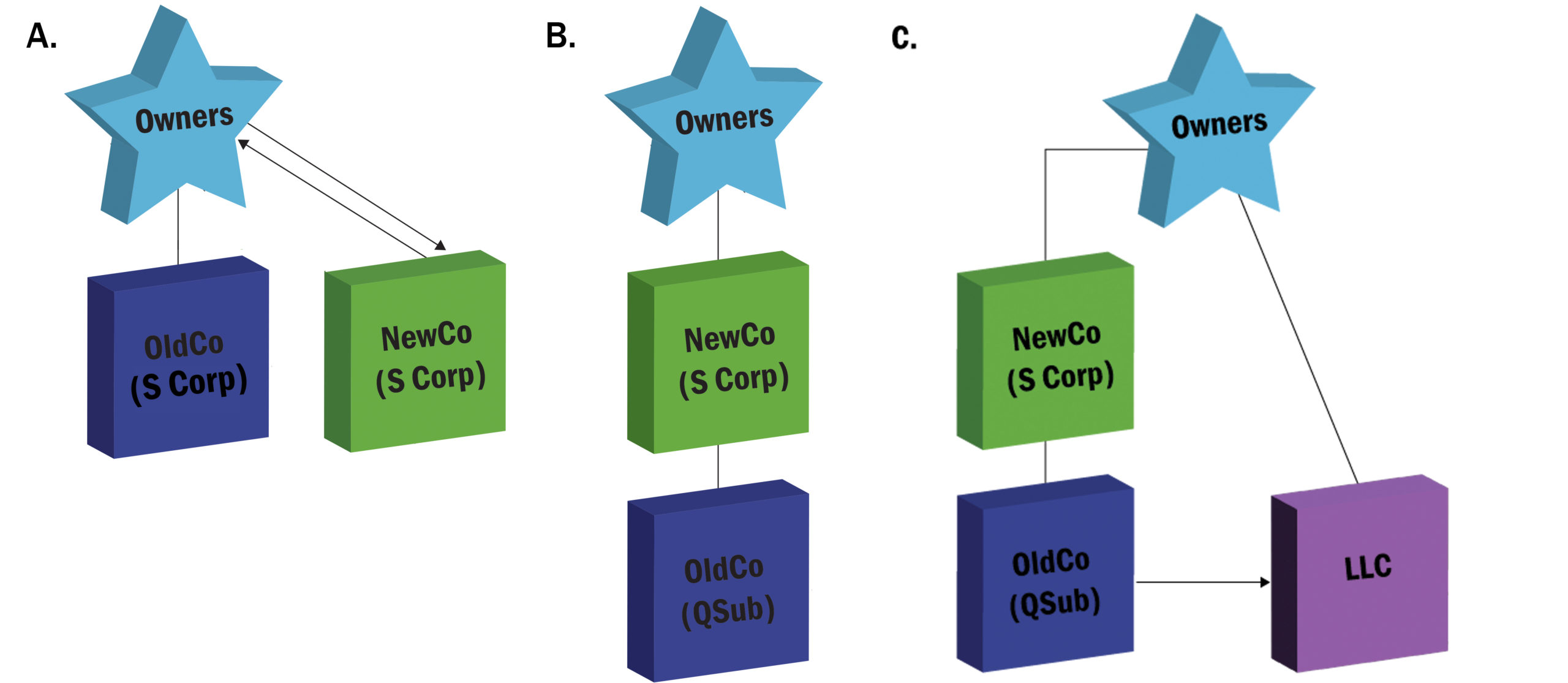

According to the IRS, these PSEs must then file the Form 1099-K for payments made in settlement of reportable payment transactions for each calendar year, which will then be sent to applicable individuals for income received through electronic forms of payments. PSEs may also request additional information from payment recipients, such as an Employment Identification Number (EIN) or Social Security Number (SSN) to properly report transactions on the Form 1099-K. If any of the payments are incorrectly labelled, payment recipients can contact the PSE directly for assistance. For instance, if the payment recipient reports their business income on a Form 1120, 1120S or 1065 and receives a Form 1099-K in their personal name as an individual (showing a SSN), contact the PSE listed on the Form 1099-K to request a corrected Form 1099-K showing the business’s EIN.

Recently, the IRS announced that calendar year 2022 will now be regarded as a transition period for purposes of IRS enforcement and administration of the third party network transactions. As a result of this delay, third-party settlement organizations will not be required to report tax year 2022 transactions on a Form 1099-K to the IRS or the payee for the lower, $600 threshold amount enacted as part of the American Rescue Plan of 2021.Instead, payment recipients will be required to report such earnings for the 2023 tax year during the 2024 tax season. To issue the Form 1099-K by mail or electronically by January 31, 2024, all tax information should be confirmed with the PSE by December 31, 2023. The sooner the confirmation, the sooner the payment recipient will be able to send, spend, and withdraw money from any payments that might be on hold.

With the new reporting requirements approaching, it is important for payment recipients to keep accurate records, such as receipts and bank statements, and be prepared to determine whether the information reflected on the Form 1099-K is taxable or non-taxable income.

This article is for informational purposes only. For tax advice or guidance, please consult your accountant directly.

Please contact us with any questions.

For additional information, please consult these sources:

https://help.venmo.com/hc/en-us/articles/4407389460499-2022-Tax-FAQ

https://www.irs.gov/forms-pubs/about-form-1099-k

https://www.irs.gov/instructions/i1099k

https://content.govdelivery.com/accounts/USIRS/bulletins/33f1ba9?reqfrom=share/

https://www.irs.gov/pub/irs-drop/n-2023-10.pdf

https://www.forbes.com/advisor/taxes/cash-apps-to-report-payments-of-600-or-more/

https://www.nbcnews.com/news/venmo-paypal-zelle-must-report-600-transactions-irs-rcna11260