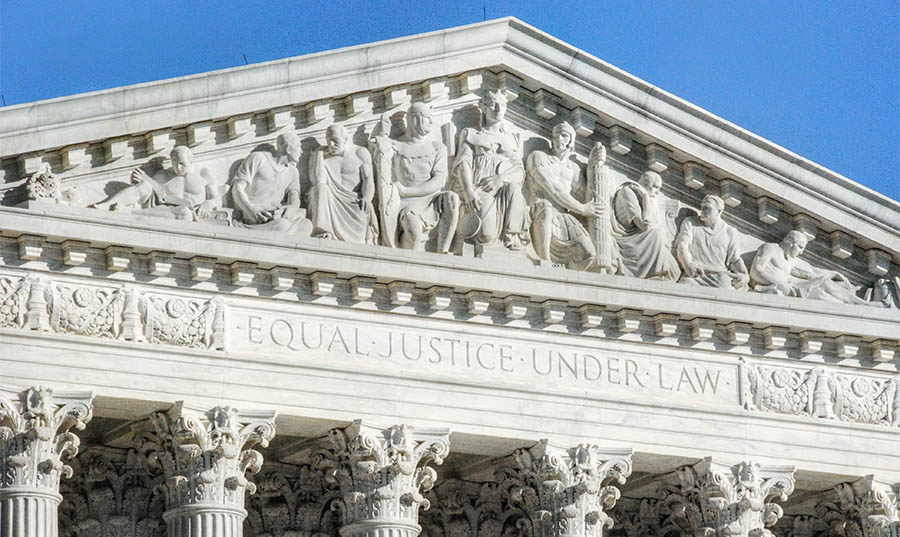

Amicus curiae briefs, also known as “friend of the court” briefs, are often filed in appellate cases heard by the United States Supreme Court (as well as state appellate courts and intermediate federal courts of appeal). Amicus briefs provide non-parties who have a strong interest in the subject matter of a case – sometimes referred to as amici – an opportunity to advise and educate the court on particular issues. Amicus briefs can play a critical role in appellate advocacy by bringing relevant information and arguments to the court’s attention that the parties have not addressed.

Once a case reaches the appellate level—especially the Supreme Court—it raises policy issues well beyond the concerns of the individual parties to the case. Consequently, courts tasked with deciding these cases want to know the broader implications of the case beyond the parties. As a result, amicus briefs have been filed on behalf of diverse amici—such as businesses, municipalities, non-profits, and business associations—each whom have specialized knowledge or expertise and advocate a unique perspective.

Amicus briefs can play a valuable role precisely because they provide different perspectives from the principal parties. They provide helpful guidance to the court about the real-world impact of its decisions.

Companies, organizations, individuals, or groups of individuals can submit arguments on behalf of themselves, encouraging courts to rule in favor of the party whose interest is most closely aligned with theirs. Considering different perspectives enriches the judicial decision-making process.

In recent years, the presence and role of amicus briefs in appellate practice has undergone a major transformation. Throughout the first century of the Supreme Court’s existence, amicus briefs were rare. Even during the initial decades of 20th century, amicus briefs were filed in only about ten percent of the Supreme Court’s cases. But recently, amicus briefs have become nearly ubiquitous. During the Supreme Court’s 2014-2015 term, 98% of cases had amicus filings (all but one case). In that term, Obergefell v. Hodges, 135 S. Ct. 2584 (2015), the Supreme Court’s landmark marriage equality ruling, had a record 148 filed amicus briefs. Most recently, during the Supreme Court’s 2017-2018 term, 890 amicus briefs were filed with an average of 14 per case.

There is sound evidence that amicus briefs have an impact. During the Supreme Court’s 2017-2018 term, the justices cited amicus briefs in 59 percent of the cases with signed majority opinions. And as a general trend, amicus briefs are now commonplace in federal and state appellate courts where they are cited to with increasing regularity.

No matter your interests, amicus briefs provide a meaningful opportunity for practical benefits. Businesses or associations can file amicus briefs explaining how the disposition of a case will affect them. Non-profits can file amicus briefs to educate the court on issues that may advance their mission, values, or society at large. Amicus briefs can even be used as a marketing tool showing tangible action on important issues. Amicus briefs now play a pervasive and critical role in appellate practice, and when used correctly, they persuade courts to make decisions that favor amici.