News (All)

News Legal Blog Upcoming Events

News

Deals

CMM Guides Client Through Business Acquisition Unwind

January 12th, 2026

Deals

CMM Navigates High-Stakes Business Divorce on the East End

January 6th, 2026

In the News

Middleton Advocates for Private Helicopter Charter in East Hampton Airport Dispute

December 12th, 2025

In the News

CMM Partner Vincent Costa Named Leadership in Law Award Honoree

November 14th, 2025

In the News

CMM Closes Commercial Real Estate Acquisition

November 6th, 2025

In the News

10 CMM Attorneys Named to the 2025 Super Lawyers® and Rising Stars List!

October 6th, 2025

In the News

Campolo Recognized as a Long Island Business Influencer in Law

September 12th, 2025

In the News

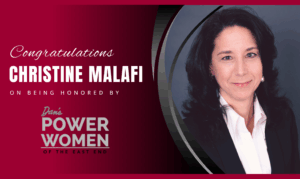

Christine Malafi Named to Dan’s Power Women of the East End

September 10th, 2025

In the News

Richard A. DeMaio Named CMM Partner

September 2nd, 2025

In the News

Legal History Insights: Summer Edition

August 25th, 2025

In the News

CMM’s Scott Middleton Featured in The Best Lawyers in America® for the 12th Year in a Row

August 21st, 2025

In the News

CMM’s Christine Malafi Featured in The Best Lawyers in America® for the 9th Consecutive Year

August 21st, 2025

In the News

Campolo Appointed Treasurer of the Board for the Guide Dog Foundation and America’s VetDogs

August 11th, 2025

Deals

CMM Closes Prime Commercial Real Estate Sale of NJ Shopping Center

July 25th, 2025

In the News

Christine Malafi Named to Dan’s Power Women of the East End

July 23rd, 2025

In the News

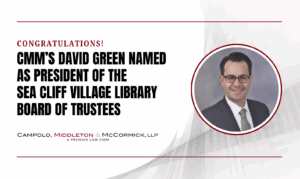

CMM’s David Green Named as President of the Sea Cliff Village Library Board of Trustees

July 15th, 2025

In the News

CMM Closes Commercial Real Estate Transaction for Non-Profit Property

May 5th, 2025

In the News

CMM Closes Sale of Architecture Firm with Latest M&A Deal

April 23rd, 2025

In the News

CMM Secures Win for East End Homeowner Association

April 11th, 2025

In the News

Rassiger quoted in Long Island Business News on Safeguarding Against Tariff Hikes

April 7th, 2025

Legal Blog

Legal Blog

Current Real Estate Market Conditions Offer Opportunities for Retail Tenants

January 5th, 2026

Landlord-Tenant

High Bar for Tenants: Court Sides with Landlord in Harassment Case

Legal Blog

2026 Changes to Minimum Wage and Overtime Exempt Salary Threshold

December 8th, 2025

Legal Blog

Why Real Estate Due Diligence is Critical in M&A Transactions

November 19th, 2025

Legal Blog

Protect Your Business from Wage Lawsuits: How Simple Recordkeeping Can Save Your Business

November 11th, 2025

Legal Blog

Rethinking Arbitration Clauses — What Business Owners Need to Know

October 31st, 2025

Legal Blog

Employment and Compensation Issues in M&A Transactions

October 24th, 2025

Legal Blog

NY Courts Issue Interim Policy on Judges’ Use of AI

October 17th, 2025

Legal Blog

The Overlooked Obstacle in M&A: Existing Debt and Its Hidden Risks

September 10th, 2025

Legal Blog

What Really Keeps M&A Deals on Track? A Closer Look at Governance and Fiduciary Duties

September 10th, 2025

Legal Blog

How Commercial Contracts Can Make or Break Your M&A Deal

September 2nd, 2025

Legal Blog

Consents and Approvals: The First Gate to Closing an M&A Transaction

August 6th, 2025

Legal Blog

Ethics and AI: What Lawyers Need to Know

June 26th, 2025

Legal Blog

Annual Business Checkup: Partnership Agreements

April 16th, 2025

Legal Blog

Annual Business Checkup: Operating Agreements

March 18th, 2025

Legal Blog

Annual Business Checkup: Shareholder Agreements

March 3rd, 2025

Legal Blog

Annual Business Checkup: Preventing a Costly Business Divorce

January 31st, 2025

Legal Blog

Understanding the New Telemarketing Consent Rule: Key Changes for Sellers & Marketers

January 27th, 2025

Legal Blog

2025 Changes to Minimum Wage and Overtime Exempt Salary Threshold

December 31st, 2024

Legal Blog

New York LLC Transparency Act Goes into Effect This Month

December 4th, 2024

Upcoming Events

January 16, 2026

Campolo Moderates HIA-LI Annual Meeting & Legislative Program

Explore Our Library

January 16, 2026

Campolo Moderates HIA-LI Annual Meeting & Legislative Program

View our archives: News, Legal Blog, Negotiation Blog, Event Photos, Business Unusual, Long Island News Radio, CMM Live, Spotlights